Fiduciary managers continued to face challenges in 2023 as focus of the market evolves

News

- Growth in the number of mandates has stalled post gilts crisis and FMs feel impact of dramatic decrease in clients’ assets under management

- With a large proportion of schemes with assets under £100m, FMs adapt their propositions to attract smaller mandate sizes – introducing competitive fees and simpler portfolios

- Portfolios are shifting. The gilts crisis has made its mark, with a greater focus on liquidity through liquid alternatives and equities to support collateral for liability hedging

- Looking forward, it is expected new schemes will enter the FM market to support their trustees with governance and to ease operational burden

In 2023, the fiduciary management market has continued to be tested as the consequences of the gilts crisis have played out across the wider pensions industry. A key challenge this year has been in the requirement for fiduciary managers (“FMs”) to source capital for LDI (“Liability Driven Investment”) portfolios to maintain liability hedging targets. However, gaining access to liquidity proved difficult for some.

Recognising change in the market, FMs took the opportunity to evolve their offerings. Smaller clients have been able to enter the market due to competitive fees and simpler portfolios. The make-up of portfolios has been adapting, with liquid alternatives and equity rising in desirability, over illiquid alternatives and credits which were popular in recent years. 71% of schemes with FMs also carried out strategy reviews over the course of the year.

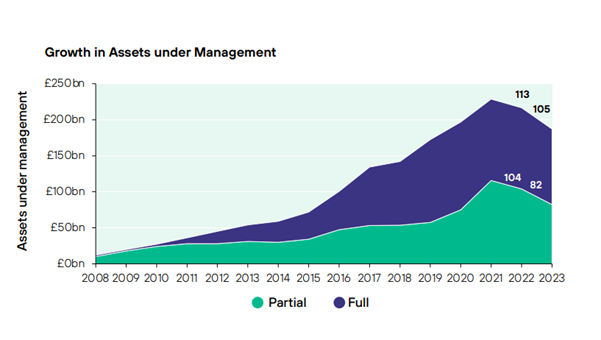

Isio’s annual FM survey ‘Latest trends in Fiduciary Management’ shows the impact of challenging market conditions for fiduciary managers. The impact of the gilt yield rises was prominent in 2022 and 2023, with falling assets under management (“AUM”) in both years. In 2023, for the first time since the survey began in 2008, the number of schemes using FM (including full and partial FM mandates) has declined.

The changing face of the FM market

There has been a notable shift in the makeup of the market, mostly explained by the decrease in AUM. More clients are now in the lower AUM buckets with 69% in the <£100m bucket up from 62% last year. In the top part of the market, mandates of over £1bn stayed the same at 3%.

A flight back to equity

Isio asked FMs how they would invest the assets of a £500m scheme, targeting a return of Gilts + 2% per annum. The response was significantly different from when they were asked in 2022. The main changes were:

- Increased liability hedging assets which is unsurprising due to new regulatory guidance around minimum collateral requirements within LDI

- Increased liquidity through a move away from illiquid assets and into liquid alternatives and equity

- A U-turn on equities with FMs substituting credit assets for equities, in particular passive equities

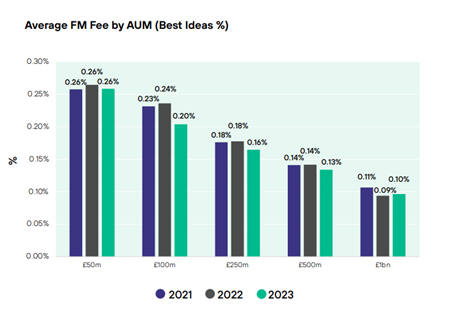

FM managers are reassessing pricing structures

Historically FM fees have been linked to AUM. With AUM having fallen over the last year and rising cost inflation also impacting FMs, some have now reassessed their fee structures. 16% are using a tiered fee (dependant on asset size) and 4% are using fee structures linked to performance. Views from FMs on whether the use of tiered fees will increase are mixed, highlighting the disparity in fees across the market.

Isio also asked FMs what their fee would be for a scheme targeting a return of gilts + 2% per annum in five different asset size buckets. This year proposed fees reduced across most buckets, showing a more competitive market for new clients.

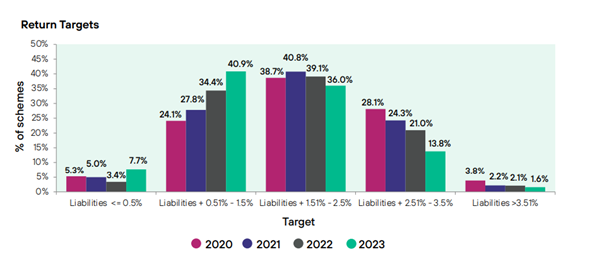

Long term objectives show a focus on end game planning

For the first time liabilities + 0.5%-1.5% is the most common return target. Domination of a low return target, rather than a high one supported by growth assets, means that the focus for the fiduciary market is shifting, with increased importance on insurance capabilities and end game planning. 14% of schemes were 3 years from buyout in 2022 rising to 18% in 2023.

As more schemes move closer to their buyout objectives, it is expected that there will be a rise in insurance transactions coming through in the next 5 years. However, insurers capacity will be a key factor in determining the extent of this.

Conversely, the number of partial buy-ins reduced over the year as schemes changed their focus to retain more liquidity within portfolios to support their liability hedge.

Average hedging level targets decreased slightly from 94% in 2022 to 87% after years of positive trajectory. With lower leverage demands in LDI mandates, greater capital and more onerous collateral requirements are now needed to maintain hedging levels. There has also been a move towards bespoke arrangements like segregated LDI to increase flexibility and efficiency. 5% of schemes moved from pooled to segregated LDI, a number expected to rise as FMs change their entire client base to segregated arrangements.

Paula Champion, Head of Fiduciary Management Oversight at Isio said: “This time last year, the gilts crisis was a recent event, and we were asking the question – has growth peaked? While this year’s findings show that it has stalled at least temporarily, the requirements from LDI portfolios during the gilts crisis have put a bigger governance burden on trustees. This has brought the governance and operational benefits from FM into the spotlight. We predict we could continue to see a gradual uptick in new schemes entering the market to reduce this burden.

The unprecedented events of last year have arguably changed the face of the industry forever, but fiduciary managers are identifying new opportunities and have continued adding value to schemes who have grappled with the market conditions and tighter regulatory landscape. The move back to equities, in particular passive equities, also emphasises that FMs understand the focus is on delivering return without sacrificing liquidity in 2023.”

Get in touch

Talk to us today to see how our bolder thinking can get you better results.